Broken Deals, Bold Ambitions: The Future of Brazil’s Broadcast Rights

A League at a Crossroads

The 2025 Club World Cup spotlighted Brazilian football like few moments before. Flamengo, Palmeiras, Botafogo, and Fluminense all performed on the global stage. For a moment, it felt like everything was aligning: talent, attention, infrastructure, engagement. All that was missing was putting a bow on it and delivering it to the world.

LIBRA and LFU, Brazil’s club-led media blocs, saw the opening. On July 10, 2025, they struck a three-year international TV rights deal with 1190 Sports. But there was one big snag: Flamengo opted out, holding back its home games and pushing them to Flamengo TV. Suddenly, it wasn’t just about broadcast rights, it was about growth, equity, and who gets rewarded for ambition.

LIBRA vs. LFU: Striking the Balance

To restructure Brazil’s media rights landscape, two competing blocs of clubs formed in 2022:

LIBRA

- Founding clubs: Flamengo, Palmeiras, São Paulo

- Proposed revenue split:

- 40% equally distributed among all participating clubs

- 30% based on sporting performance (league finishes, titles)

- 30% based on audience metrics (TV ratings, digital reach)

- Sources: pt.wikipedia.org

LFU (Liga Forte União)

- Founding clubs: Corinthians, Botafogo, Fluminense, Cruzeiro

- Proposed revenue split:

- 45% equally distributed

- 30% based on sporting performance

- 25% based on audience metrics

- Sources: pt.wikipedia.org

By 2025, both groups united to finalize a three-year international broadcast deal with 1190 Sports, but Flamengo opted out, refusing to contribute its home match rights.

The club’s leadership argued that the revenue structure, especially the “equal” and “audience” portions, failed to reflect Flamengo’s outsized contribution to domestic viewership and global engagement.

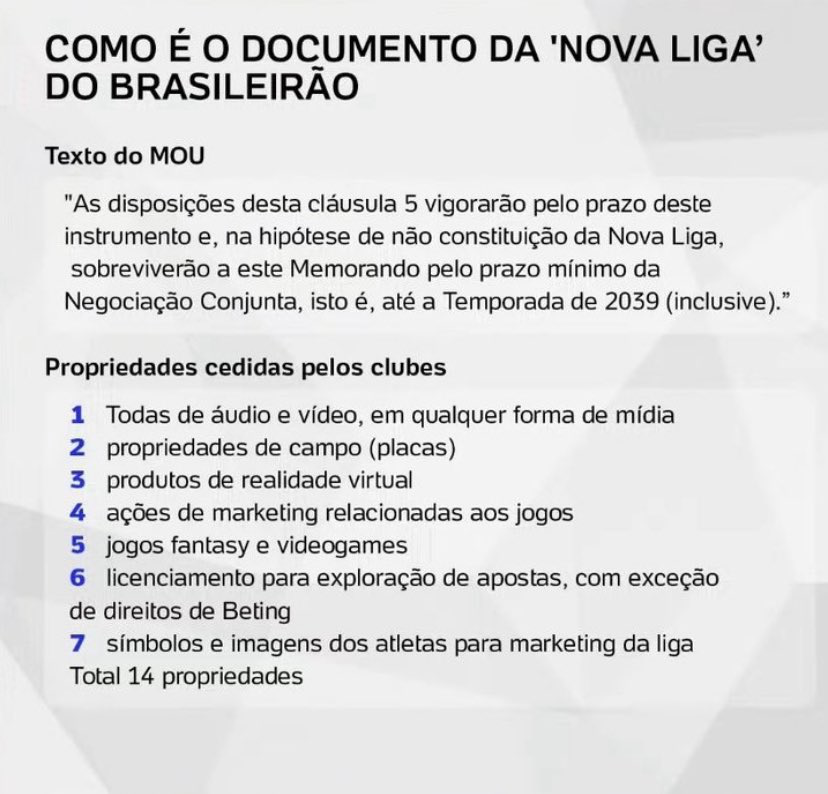

What the Nova Liga Proposal Asks of Clubs

The Nova Liga MOU (Memorandum of Understanding) isn’t just a broadcast agreement; it’s a wide-reaching commercial package. Participating clubs aren’t simply licensing TV rights. They’re being asked to contribute nearly every monetizable element of their brand into a centralized model, including:

- Official club media channels (YouTube, social content, OTT platforms)

- Digital IP (Intellectual Property) and archives

- Fantasy and gaming rights

- Player image and likeness usage

- In-stadium sponsorship and advertising inventory

- Data and commercial rights across VR, betting, and fan engagement platforms

This is a full-stack league strategy, modeled more on entertainment franchises than traditional league splits. The goal is to sell Brazilian football as a unified media product to sponsors, broadcasters, and digital platforms worldwide.

But here’s the catch: the model only works if it rewards contribution proportionally.

Clubs with massive audiences, like Flamengo, are being asked to hand over their full commercial ecosystems with no guarantee of scaled return. And because the MOU stretches until 2039, this isn’t a one-season gamble. It’s a long-term structural shift.

It’s not just about TV anymore. It’s about how club identity, fanbase value, and global brand presence are monetized on every level, from TikTok shorts to stadium LEDs to VR fan experiences.

One line from the MOU makes the stakes clear:

“The provisions […] shall survive this Memorandum for the minimum period of Joint Negotiation—i.e., until the 2039 season (inclusive).”

In total, the Nova Liga structure proposes centralizing 14 commercial assets, including:

- Audio and video rights

- Stadium signage and sponsorship zones

- Virtual reality content

- Fantasy licensing and data IP

- Betting integrations

- Player likeness and personality rights

- Merchandising, collectibles, and fan tech

That’s not just revenue sharing. That’s brand licensing at scale.

And if you’re Flamengo, by far the largest commercial force in Brazilian football, you’re not just giving up TV time. You’re giving up the leverage you’ve spent decades building.

Look, this isn’t a bad idea. In fact, it’s smart. It’s modern. It mirrors what top leagues are doing elsewhere. But it has to be built on respect for value, not artificial parity. You don’t sell a blockbuster and leave the star off the poster. And Flamengo is saying clearly: they’re not signing unless the billing matches the box office.

This kind of unified media deal could modernize the Brasileirão. It could fuel the league's international growth. But it doesn’t work if your biggest driver loses money. And it definitely doesn’t work if your top club feels like a donor instead of a partner.

You want this league to shine? Then you need your biggest star in the room, and happy to be there.

CBF: Still Decider of Calendar, Not Contracts

For decades, the CBF (Brazilian Football Confederation) controlled the commercial rights to Brazilian football, including domestic and international broadcast deals. But in recent years, that dynamic has changed. With the emergence of LIBRA and LFU, clubs have taken control of their own media destinies. The CBF’s role today is largely administrative: it manages the match calendar, oversees refereeing and disciplinary matters, and handles the national team. But when it comes to league-level commercial strategy, it no longer holds the pen.

This shift mirrors global trends, but Brazil’s execution remains fragmented. In England, for instance, the Premier League is a fully independent entity, distinct from the FA, with centralized control over sponsorships, media rights, and international growth. The FA governs domestic cups and national teams, but doesn’t interfere in league business. Spain follows a similar model: La Liga is run independently of the Spanish federation (RFEF), with full control over its own commercial footprint. Even in Germany, the Bundesliga’s commercial wing (DFL) operates separately from the German federation (DFB), which focuses on cup competitions and national oversight.

Brazil, on the other hand, has attempted to shift power to the clubs, but hasn’t yet created a true league structure to unify them. Instead of one centralized body like the Premier League or La Liga, Brazil has two voluntary alliances (LIBRA and LFU) that must negotiate among themselves and then with outside partners. It’s a delicate balance, and Flamengo’s refusal to sign onto the shared deal highlights just how fragile this decentralized model is. Without Brazil’s most valuable club at the table, the league's collective leverage weakens, and the cracks in the foundation become impossible to ignore.

“We’d Lose Money in This Model”

Flamengo President Rodolfo Landim (BAP) didn’t mince words:

“When will I accept receiving just 3.5× more than small clubs? NEVER. Flamengo would lose money in this model.”

Flamengo TV

And he’s not just speaking emotionally, he’s defending Flamengo’s dominant market position.

As of 2024, Flamengo had the highest operating revenue in Brazilian football at USD 212 million$212 million, with an estimated 46.5 million fans inside Brazil, about 22% of the national football fanbase. Add to that over 60 million social followers, and you have the only Brazilian club featured in the Deloitte Football Money League Top 30.

The reality is, Flamengo holds the unique combination of massive fan volume and recent and historical sporting merit. No other Brazilian club can currently make that claim. The unspoken concern is that Flamengo may scale so far ahead that the league becomes lopsided, like Bayern Munich’s dominance in the Bundesliga. That’s a valid fear.

But let’s be honest: that imbalance isn’t manufactured, it’s earned. And while I personally don’t want a one-club league, I also believe it’s absurd to penalize a club for doing things right. Flamengo’s audience isn’t theoretical. It’s visible on TV, in stadiums, across social media, and in sponsor interest.

Would we be having the same debate if Palmeiras were in this position instead of Flamengo? Their fanbase has grown in proportion to their on-field success. They followed the same blueprint. The only difference is Flamengo’s scale.

| Club | Revenue (USD) | Valuation (USD) | Social Followers (M) | Estimated Fanbase (M) |

|---|---|---|---|---|

| Flamengo | $212M | $880M | 60 | 46.5 |

| Palmeiras | $147M | $706M | 23.5 | 23.5 |

| Corinthians | $139M | $680M | 37 | 33 |

| São Paulo | $127M | $650M | 22 | 17 |

| Atlético-MG | $115M | $620M | 18 | 12 |

| Botafogo | $89M | $420M | 10 | 6 |

Source: SportsValue 2024 Club Report

The Business Gap in Black and White

These numbers don’t just speak, they scream. Flamengo isn’t just ahead of the pack; they’re in a different weight class entirely.

Let’s start with revenue: $212 million. The next closest? Palmeiras at $147 million. That’s a $65 million gap. A whole new tier. Valuation? Flamengo sits at $880 million, nearly $200 million more than any other Brazilian club. They aren’t just making more; they’re worth more, too.

And it’s not just about money. Flamengo has 46.5 million fans inside Brazil. That’s almost double Palmeiras, triple São Paulo, and nearly eight times Botafogo. On social? 60 million followers and climbing. Flamengo isn’t just a football club; they’re a media property, a global brand, a cultural machine.

Want proof that performance grows fanbases? Here’s Palmeiras’ growth over the past two decades:

Palmeiras: Legacy + Growth

| Year | Titles | Est. Fanbase (M) |

| 2000 | 6 | 10 |

| 2010 | 6 | 12 |

| 2015 | 7 | 14 |

| 2018 | 9 | 16 |

| 2020 | 11 | 18 |

| 2021 | 12 | 20 |

| 2023 | 14 | 22 |

| 2024 | 15 | 23.5 |

Palmeiras deserves credit. Their fan base grew as their team started winning. From 10 million in 2000 to over 23 million today, that’s proof that success builds scale. They’ve done it right. Built, not begged.

Corinthians is a curious case. Massive fanbase. Great stadium. Huge platform. But with only $139 million in revenue and a lack of recent sporting success, they’re underperforming. That’s not about unfair models, it’s about internal mismanagement. You can’t just have fans. You have to deliver for them.

And then there’s the rest: São Paulo, Atlético-MG, Botafogo. Respect to their history. But right now, they’re behind. They might close the gap with the right strategy, but they’re not there yet.

So let’s stop pretending Flamengo is just being selfish. This isn’t charity. It’s business. Flamengo has the fans, the numbers, the performance, and the value. If they say they’d lose money under this model, they probably would. And the data backs that up.

If other clubs want more, they need to earn it, just like Palmeiras did. Flamengo’s not the problem. They’re the blueprint and the key to growing this league.

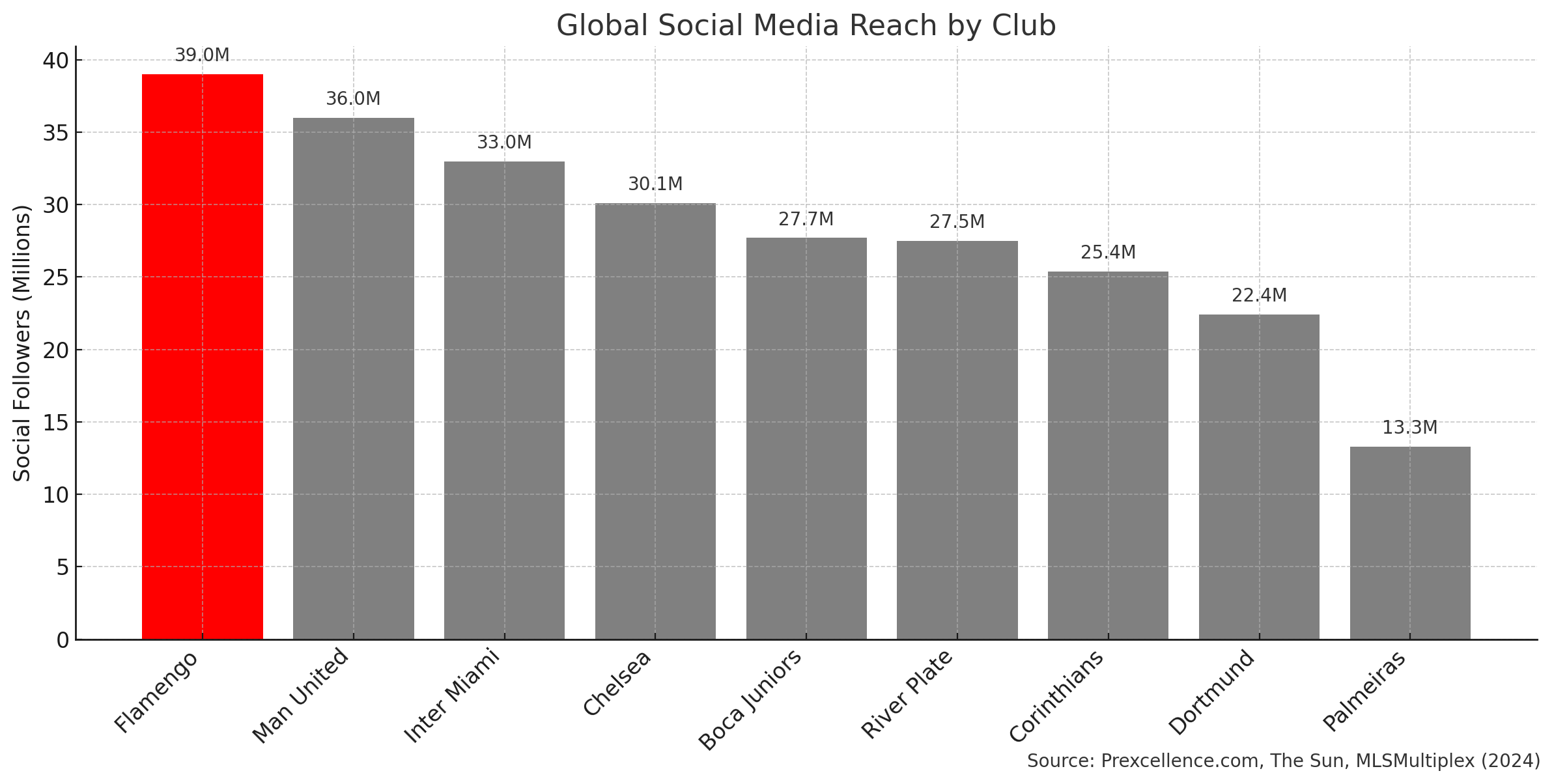

Flamengo’s Global Ascendance

Let’s be honest, Flamengo isn’t just a Brazilian giant. They’re one of the few non-European clubs operating on a global scale.

With over 39 million followers across social platforms, Flamengo leads every other Brazilian team by a mile. For comparison, Corinthians has around 25.4 million. Palmeiras? Just 13.3 million. No one else is close.

Source: Prexcellence Digital Rankings – Brasileiro 2024

But it’s not just volume, it’s engagement. Flamengo ranks ahead of global clubs like Borussia Dortmund and even Chelsea in social media activity and reach.

Source: FIFA CWC engagement data (via MLSMultiplex)

According to the CIES Football Observatory, they’re the highest-ranked non-European club in the world by total followers, sitting 15th globally.

Source: The Sun – Most Followed Clubs 2024

Let’s go further: Flamengo has more digital reach than Inter Miami (33M), Boca Juniors (27.7M), and River Plate (27.5M), three of the most famous non-European brands in world football.

Source: Inquirer – Club World Cup Market Impact

This isn’t an accident. It’s years of strategy. Flamengo’s friendlies in the U.S., partnerships with SPORTFIVE, and strong domestic performance all pushed their brand internationally. They didn’t just ask for attention; they earned it.

The Broadcast and Gatekeeping Giant

When it comes to domestic influence, there’s Flamengo, and then there’s everyone else.

A routine league match, like Flamengo’s 6–1 demolition of Vasco, drew over 30 rating points on Globo in Rio, making it one of the most-watched matches of the year (Observatório da TV). Their Copa do Brasil quarterfinal clash against Bahia? 27 points and a 48% share (Maquina do Esporte). And in the Copa do Brasil Final, Flamengo delivered a staggering 34-point average and 57% share, setting a new high-water mark on Rede Globo for the season (777score).

On the ground, Flamengo leads all clubs in average home attendance, drawing ~51,600 fans per match in 2024. Palmeiras follows at ~31,100, and Botafogo at ~25,000 (GE).

Average Home Attendance – 2024 Série A

| Club | Avg. Attendance |

|---|---|

| Flamengo | 51,644 |

| Corinthians | ~43,600 |

| São Paulo | ~39,900 |

| Palmeiras | ~31,100 |

| Botafogo | ~25,000 |

Source: ge.globo.com – Público e Renda Brasileirão 2024

And yet, some critics point to the Club World Cup and say, “Palmeiras and Botafogo had higher attendance.” Sure, that happened in single, hyped matches on U.S. soil. But that’s a snapshot, not a system. Over the course of a season, Flamengo is the club that fans turn on the TV for and the club they show up for. Their relevance isn’t momentary. It’s structural.

This isn’t just popularity; it’s purchasing power. It’s why sponsors pay more. Why advertisers follow. Why viewership drives revenue in every modern rights model. Flamengo isn’t just a big club; they’re the engine powering the entire domestic media ecosystem.

If that's not enough, how about taking a look at Globo's reporting on Flamengo after the Flamengo x Bahia game mentioned before? Of the Top 20 most attended games in Brazil across all comps, 9 of them were Flamengo, and all of the top 6.

So no, you can’t grow the pie by shrinking Flamengo’s slice. If they say they’d lose money under the proposed revenue model, that’s not posturing. That’s math. Validate the concern. Because asking the club that generates the most attention and value to accept less, simply for the sake of fairness? That’s not a strategy. That’s sabotage.

International Comps: NBA and Premier League

Let me make this personal for a second. I’m a Denver Nuggets fan, a small-market supporter who’s spent years watching my team live in the shadow of the Los Angeles Lakers. I get tired of the coverage they get, the national TV slots, the constant headlines. But I also get it.

They bring in engagement. They bring in sponsors. They drive revenue, storylines, impressions, and growth for the entire NBA. And guess what? They don’t win every year. They’re not unbeatable. But their value is undeniable.

It would be selfish of me to say the Nuggets deserve the same money, visibility, or licensing just for showing up. Until we earn that audience, on and off the court, we don’t deserve the same cut. That’s not punishment. That’s reality.

Now, look at the NBA model. Yes, revenue is shared more equally than in most leagues. But teams like the Lakers and Warriors still dominate in sponsorship value, media deals, and overall franchise valuation. Why? Because they’ve earned it through brand building, star power, and consistent attention.

Let’s talk about the Warriors.

| Year | NBA Titles | Warriors Valuation (USD B) | Record |

| 2009 | 0 | 0.315 | 29–53 |

| 2015 | 1 | ~3.0 | 67–15 |

| 2022 | 4 | 8.8 | 53–29 |

This growth wasn’t gifted to them through league balance. It was built. Through performance, identity, and elite management. Valuation follows merit. Period.

Now jump across the Atlantic.

The Premier League has one of the most equal revenue models in football, far more balanced than what LIBRA or LFU propose. Yet clubs like Manchester United, Liverpool, and now even Manchester City still dominate commercial income. Why? Because they pull in the most global fans, media attention, and brand interest.

Here’s the key difference: in the Premier League, equality doesn’t mean flatlining success. It means giving everyone a floor, but still allowing the ceiling to reflect actual value.

In Brazil? We’re not there yet. We don’t have the global scale to absorb poor incentives. We’re still building. And to build fast, we need to reward the clubs that are growing, not punish them.

If we want a league that competes with the Premier League one day, we need to embrace the ambition and scale of our biggest brands, not suppress them in the name of fairness.

A Marketer’s Perspective: Passion, Not Pity, Drives Spend

In my day job, I’m a marketer. I run sponsorships across mass media, influencers, podcasts, TV, digital, and sports. And here’s the uncomfortable truth: I’ve passed on sponsorships from leagues like MLS, the NBA, and even the NFL. Why? Not enough engagement. Not enough attention.

I’d love to invest in sports. I believe in the power of sports to build brands. But my budget isn’t charity. It follows eyeballs, passion, and return on attention. If you can’t prove that my brand will be seen, talked about, or felt, I’m not spending. Full stop.

This is why I get frustrated when people talk about redistributing money to smaller clubs “for the good of the league.” That’s not how this works in the real world. As a buyer, I don’t care about equality. I care about impact.

I’ve worked with a brand that has sponsored the Premier League, and let me tell you, that money didn’t go there for parity. It went there for passion, for the emotional weight of the badge, for the global scale of a Liverpool or Manchester United match. Premier League teams don't win your ad dollars with handouts; they win them by building something people want to be a part of.

The same is true in Brazil. The league won’t earn my sponsorship dollars just by being fair. It’ll earn it through years of aggressive growth, through teams that work to capture attention and scale the audience. Right now, Flamengo is the only one clearly operating at that level, and they’re the first team that would get my budget. There are many that follow closely behind, but the majority of the league isn't there.

If other teams want a bigger piece of the pie, it’s not about flattening the revenue split. It’s about proving they can grow the pie. For you as a fan, for them as teams, and for me as an advertiser.

That’s why I support a hybrid model, not a charity model. Reward ambition. Incentivize scale. Let success be the blueprint, not something we ask clubs to apologize for.

Build Together, But Reward the Builders

We all want the pie to grow. A stronger league benefits everyone, from the smallest club to the biggest broadcaster. But that growth can’t come by shrinking the slice of the club doing the most work.

You don’t grow the league by asking Flamengo, the club driving the most global attention, engagement, and revenue, to take a financial loss for the sake of others. If they say they’d lose money in this model, validate that concern. They’re not bluffing.

You can’t do this without Flamengo.

And Flamengo can’t do it without the league.

But that relationship has to be mutual, not manipulative.

Asking Flamengo to be charitable?

That’s just stupid.

Saying they’re holding the league back?

Stupid.

Trying to rig shortcuts to close the gap instead of earning your way up?

Even worse.

If you want more revenue, build more value.

If you want bigger audiences, earn them.

Flamengo didn’t win by luck. They showed the blueprint. Now follow it.

Brazilian football has a choice to make:

Limit success to protect parity,

or structure the league to reward ambition and raise the ceiling for everyone.

Flamengo shouldn’t be punished for getting it right.

They should be the proof that it’s possible.

And a challenge to every club: match it.

If you feel like supporting Reserves FC, give us a follow on any of the below and let's start a conversation. We're looking to improve the dynamic of the current football landscape. Jump in, talk about anything, crack open a beer if you'd like. We want to chat!

Comments ()